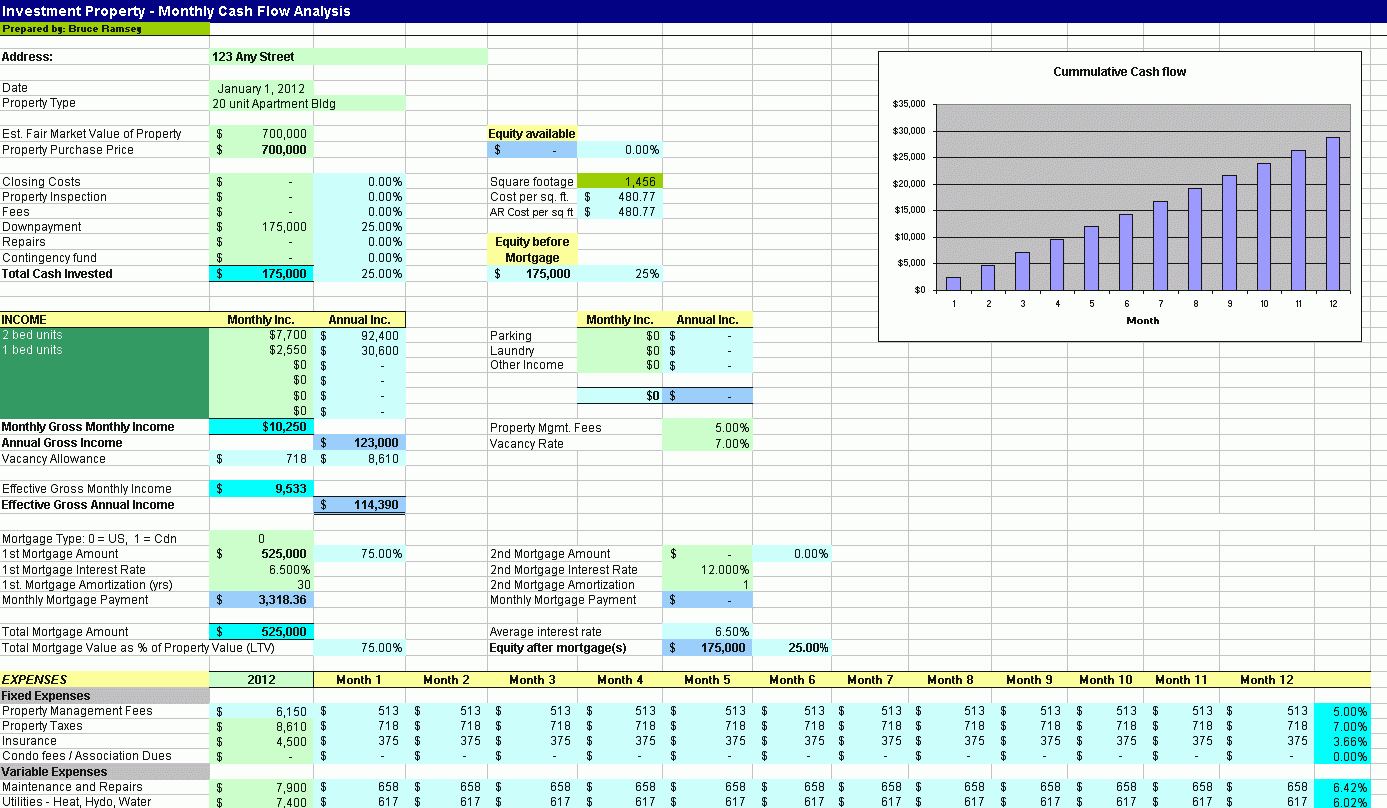

2- Make sure to get accurate estimates for the costs

Much like the estimated monthly expenses, these costs are also subtracted from the gross rental income.

#CASH FLOW PROPERTY CALCULATOR PROFESSIONAL#

Examples of this include professional property management fees, HOA fees, and monthly mortgage payments. In fact, the 50% rule does not factor in expenses that are not directly required to own and operate an income property. Keep in mind that not all expenses are included in these estimates. Like we mentioned above, these costs cover most of the recurring expenses that are associated with operating rental properties. The first thing you need to be aware of when using the 50% rule in real estate is all the expenses that it factors in. 1- Determine the costs that are included and the ones that are not With this in mind, here is how you should use the 50% rule when you’re looking at different potential real estate investments.

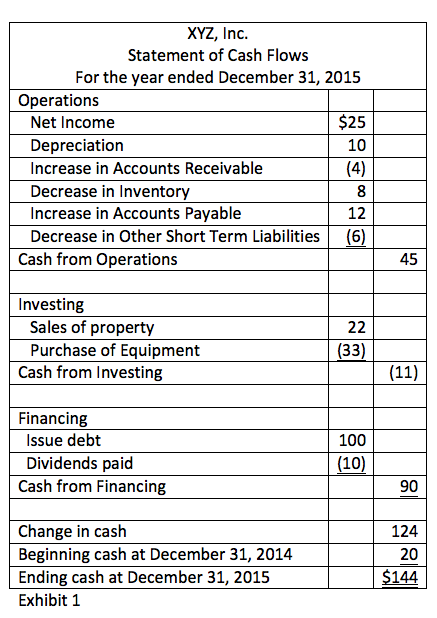

In fact, you still need to carry out an in-depth real estate analysis to properly assess cash flow. It is important to keep in mind that the 50% rule should only be used as a screening tool.

#CASH FLOW PROPERTY CALCULATOR HOW TO#

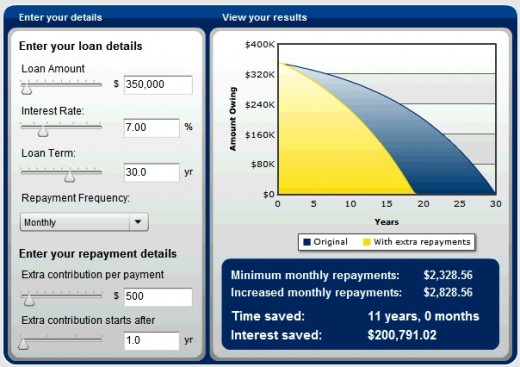

Related: Learn How to Calculate Rental Property Cash Flow How to Use the 50% Rule in an Effective Manner Now that you are familiar with the concept of the 50% rule, let’s delve into how to find cash flow properties using it. The investment property’s monthly rental income: $4000 Below is a brief example that illustrates how to estimate real estate cash flow with the 50% rule. Such costs include everything from property taxes and insurance to repairs and maintenance expenses. This method posits that rental property expenses will make up 50% of the gross income. The premise of the 50% rule is fairly simple. Using it allows you to narrow the search down to high potential real estate investments. In simple terms, this is a convenient tool that gives you ballpark estimates of each property’s cash flow. But when you are in the midst of the property search, you can’t afford to analyze each investment property in detail. Generally speaking, the best way to calculate cash flow in an accurate manner is to carry out a thorough investment property analysis.

W hat Is the 50% Rule in Real Estate ?Īs you would expect, finding profitable investment properties starts with figuring out how to estimate cash flow. So what is the most effective approach to investing for cash flow ? And what are some of the methods that you can use to accurately assess the cash flow of an income property? In this article, we will introduce you to the 50% rule and show you how to use it when real estate investing for cash flow. Needless to say, mastering the ability to zero-in on rental property cash flow is a must. Real estate investors who are able to consistently find positive cash flow properties can expect a sizable return on their investment every single time they buy a property. Company Number 08149173.Identifying profitable investment properties is the key to success in the housing market. Preston Baker Financial Services Ltd is a limited company registered in England at 99 Walmgate, York YO1 9UA. Any other product or service offered by Preston Baker Financial Services Ltd may not be the responsibility of First Complete Limited and may also not be subject to regulation by the Financial Conduct Authority. First Complete Limited is only responsible for the service and quality of advice provided to you in relation to mortgages, protection insurance and general insurance products. Preston Baker Financial Services Ltd is an appointed representative Primis Mortgage Network, a trading name of First Complete Limited which is authorised and regulated by the Financial Conduct Authority. Preston Baker & Associates Ltd introduces to Preston Baker Financial Services Ltd For the provision of mortgage and protection advice. Preston Baker & Associates Ltd is a limited company registered in England at 99 Walmgate, York,

0 kommentar(er)

0 kommentar(er)